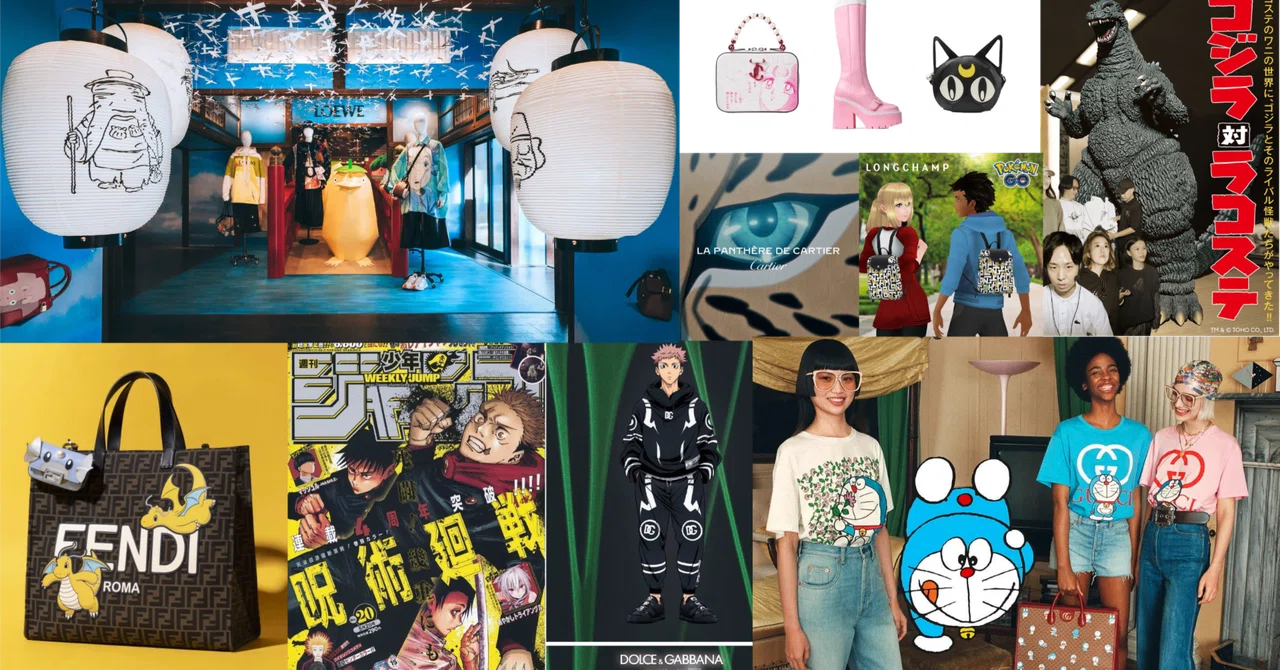

Luxury × Japanese Anime: How LOEWE, FENDI and Others Turn IP Collaborations into Brand Equity

Overview: Why Luxury × Japanese IP Now?

Luxury brands × Japanese IP is no longer just about “generating buzz.” In 2024, the personal luxury market was flat to slightly negative worldwide; according to Bain & Company, the personal luxury market contracted by roughly 2% year‑on‑year in nominal terms and entered a normalization phase. While purchasing intent among younger and aspirational cohorts softened in Europe and the U.S., Asia bifurcated: even as Mainland China wavered, Japan and parts of Southeast Asia showed relative resilience, supported by travel trends and urban development. Against this backdrop and regional divergence, brands have begun to treat IP collaborations as a re‑design of “entry points” to new customers.

Within that context, LOEWE stands out. In the Lyst Index it captured the #1 spot as the world’s “hottest brand” in Q2 2024, with search volume up 29% over the three months of that quarter, and then returned to #1 in Q1 2025. In addition, the Vogue Business Index (H2 2024) shows LOEWE entering the top ten for the first time (up five ranks), while FENDI also re‑entered the top ten — a composite trend across external indicators that substantiates a rise in brand equity (awareness and buzz intensity). Notably, LOEWE had already taken its first‑ever #1 in Q2 2023 (up 13 ranks from the prior year), demonstrating sustained heat over the past few years. Underpinning this upswing were moves such as LOEWE’s trilogy collaboration with Japanese IP (Studio Ghibli) and FENDI’s decision to appear inside Pokémon GO, a platform where young audiences spend their daily time.

This article examines how major cases — including LOEWE and FENDI — are converting the “heat” of Japanese‑origin IP into brand equity across four axes: (1) design that imprints brand–IP affinity into brand assets; (2) the architecture of touchpoints; (3) temporal staging that builds peaks via night‑before premieres, chaptered rollouts, and always‑on presence; and (4) strategic choices that prioritize building a singular brand by accumulating cultural capital over short‑term sales.

LOEWE × Studio Ghibli (2021–): Craftsmanship as Trilogy

From My Neighbor Totoro (2020) to Spirited Away (2022) and Howl’s Moving Castle (2023), LOEWE used a chaptered sequence to express its signature of craftsmanship — the brand’s core signal — through Studio Ghibli in new forms. The campaign language was unified under Juergen Teller’s photography, deliberately imprinting “LOEWE = craftsmanship” on younger audiences via a beloved IP. Crucially, this did not end as short‑term buzz; it lifted LOEWE’s brand equity and contributed to its sustained position at the top of the hottest‑brand rankings. The Ghibli trilogy functioned as a sustained touchpoint: a set of products where “brand symbol × IP symbol” overlap in a single, compelling frame — directly contributing to brand equity accumulation.

FENDI × FRGMT × Pokémon (2024–): Always-On via Pokémon GO

The core of this case is Pokémon GO. From January 4, 2024, for one full year, select stores hosted FENDI‑sponsored PokéStops and distributed avatar hats and T‑shirts. Rather than a one‑off pop‑up spike, FENDI persisted as a touchpoint inside a daily‑active app, remaining present in young users’ time. Because spins around the store translate into footfall, the structure simultaneously raises digital contact frequency and in‑store contact density.

On the physical collection side, Peekaboo and Baguette — FENDI’s own icons — were overlaid with Dratini, Dragonair, and Dragonite, using the IP’s visibility to re‑imprint the brand’s signals. The result is a loop in which in‑game visits, street‑level pop‑ups and hero products reinforce one another over time.

JIMMY CHOO × Pretty Guardian Sailor Moon (2nd Drop, 2024)

Timed to launch with pop‑ups at Isetan Shinjuku and Hankyu Umeda, the second JIMMY CHOO × Pretty Guardian Sailor Moon drop placed 24 collectible cards inside each item, designing a post‑purchase Trading Card Game–style collecting/trading experience familiar to Gen Z. The reason to go (the event) → reason to buy (the card) → reason to talk (UGC on social) forms a continuous arc: it broadens first contact and, via a “brand token that stays in hand,” carefully builds recall along the customer journey.

Dolce & Gabbana × Jujutsu Kaisen (2022)

Dolce & Gabbana appeared squarely inside the fandom’s “mothership” with official anime key art and a large‑scale Shibuya pop‑up (ZeroBase Shibuya). When luxury intersects a weekly‑manga IP, the contextual “jump” needs legitimation; here it’s established by the authority of official visuals together with a street‑level place to experience. The touchpoint sequence — page → city → store — efficiently moves younger audiences from “I know it” to “I handled it.”

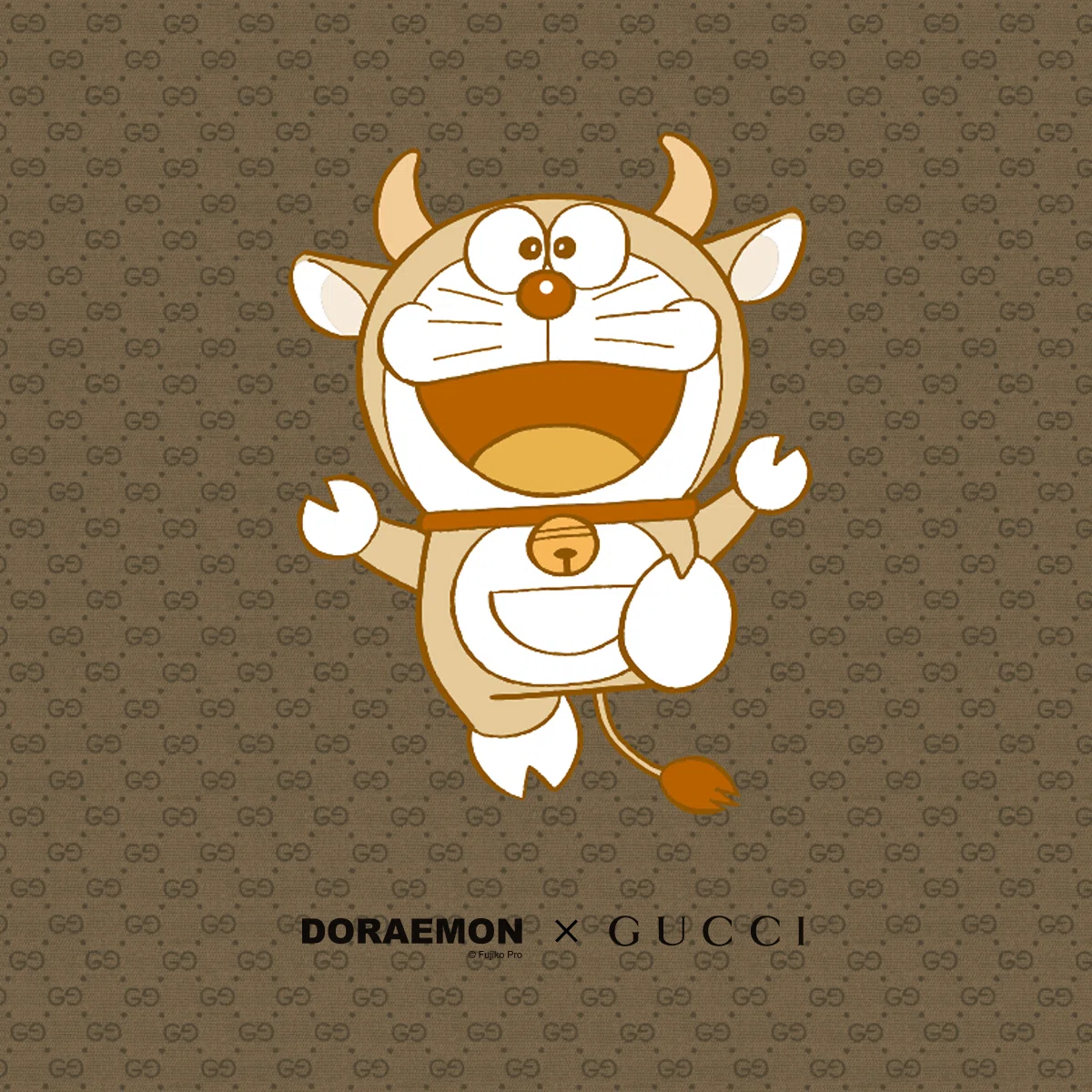

Gucci × Doraemon (2021): Pattern × Character × Occasion

Gucci stacked Lunar New Year × the GG monogram × a national icon (“Ox Doraemon,” Year‑of‑the‑Ox edition) to create layered reasons for first contact. The January 20 full rollout → February 12 LNY peak staged a stepped cadence, turning the holiday timeline into a sales waveform. Reception was mixed (including criticism of pandering), but the single‑frame legibility of “pattern + character” unquestionably maximized code transmission, and the design’s link to annual repetition (the occasion) contributed to brand equity growth.

Balenciaga × Hello Kitty (2019–2020)

At Paris Fashion Week SS20, Balenciaga staged male models with Hello Kitty bags, using “whiskers as shoelaces” to translate kawaii into the house’s subversive language. The time design from first appearance (Sept 2019) to release (Jan 27, 2020) matured anticipation — maximizing the free distribution of news value — while keeping the distance of a high price point so that many see, but only some buy.

CHANEL × The Promised Neverland (2021)

CHANEL lowered the barrier to participation for young audiences through cultural investment without having to sell directly: an exhibition at CHANEL Nexus Hall paired with the original short‑story volume miroirs. Using an exhibition timeframe — “come whenever you can” — and extending memory via window displays and connections to KYOTOGRAPHIE, the house inscribed itself in the city’s memory. By forgoing short‑term sales to imprint an aspirational brand image, CHANEL provided an on‑ramp for audiences not yet ready to jump straight into the highest price tiers.

Cartier “LA PANTHÈRE DE CARTIER” Anime (2025)

Cartier did not borrow external IP. With manga artist Naoki Urasawa as creative partner, the house animated its own icon, Panthère, and held a world premiere on LINE VOOM at 9:00 p.m. on September 18, the night before its Cartier Ginza 4‑Chome Boutique opened on the 19th — bridging heat directly into opening day. The voice cast includes Mitsuki Takahata and Kaya Kiyohara, among others.

By foregrounding Urasawa, Production I.G, and a high‑profile cast, Cartier permanently installs the narrative as a brand asset — closer to a revisit‑able collection piece than an ad. It leverages youth culture platforms (anime/streaming) while avoiding dependence on borrowed IP, suggesting a path where luxury houses author their own content universes.

In Summary: From Borrowed Heat to Owned Equity

If the goal is to increase "first meetings" with latent and new young customers, then IP collaborations are indeed one of the fastest routes. Whether those meetings convert into brand equity hinges on four points:

- Design that overlays the brand's symbol and the IP's symbol in a single, legible frame

- Choosing which touchpoint becomes the stage of expression

- A time strategy that balances moments (peaks) and frequency (always‑on presence)

- A long‑term stance that includes "not selling" cultural investments and, where possible, authoring your own IP (as with Cartier)

LOEWE executes these four points with exceptional clarity and — consistent with multiple indices such as the Lyst Index — has become a frequent #1 among the most dynamic brands in recent years. The rise in awareness and conversation heat has translated directly into added brand value, making LOEWE a prime example of turning "borrowed heat" into owned brand equity.

Want to design your own IP collaboration?

Talk directly with NextGens about luxury brand strategy, anime/IP partnerships, or Japan market entry.

💬 Chat on WhatsApp