How Japan Turns Theme Parks into a Composite Asset Class

Japan can be called a theme-park advanced nation because there are simply so many parks relative to its population — from global majors like Disney and Universal to regional character parks, historical recreations, and illumination parks. Almost every region has its own destination, and the density per capita is among the highest in the world. Combined with Japan’s rich supply of IP (anime, characters, games) and very refined daily operations, it makes theme parks a normal part of leisure life — not a rare luxury.

Press enter or click to view image in full size

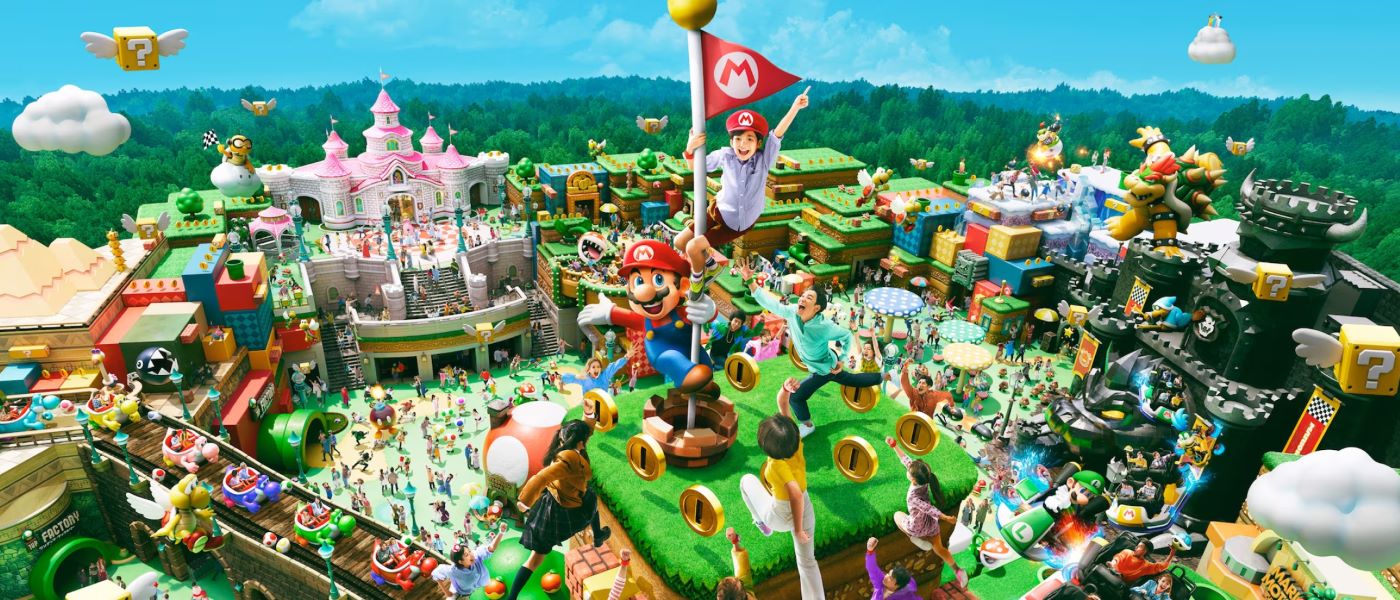

Super Nintendo World at Universal Studios Japan

Japan’s theme parks are no longer “just entertainment.” They translate heavyweight IP into physical worlds and monetize scarcity through variable pricing, timed entry, and capacity control — producing predictable cash flows and behaving like a composite asset (IP × operations × real estate). What sets Japan apart is not size but operating craft: no other market simultaneously normalizes experience quality daily, co‑owns the experience with sponsors, and staffs with fandom‑native talent to raise satisfaction per minute.

Tokyo DisneySea’s Fantasy Springs is the clearest proof: ~140,000 m² and ~¥320 billion (~$2.16B) in capex, explicitly treated in IR as a return engine where price, guest flow, and supply are designed together. That “price is the dependent variable” philosophy — rare outside Japan — allows yield without breaking the on‑site rhythm.

Press enter or click to view image in full size

Fantasy Springs by tokyodisneyresort.jp

A Short History: From “Global IP × Japanese Capital” to “Domestic IP × Chaptered Operations”

The lineage runs from Asakusa Hanayashiki (1853) through the high‑growth era of Yomiuriland and Fuji‑Q Highland, then inflects in 1983 with the opening of Tokyo Disneyland — the moment Japan established a distinctive model: license global IP, keep domestic ownership and operations.

Press enter or click to view image in full size

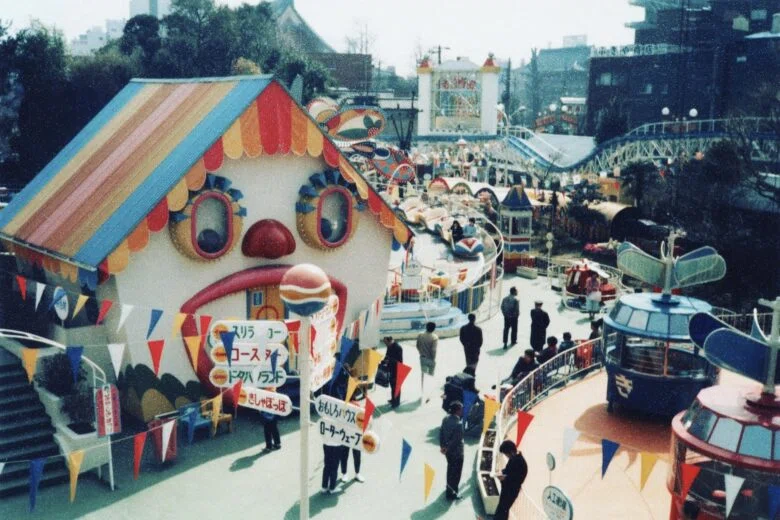

Hanayashiki (1853)

Press enter or click to view image in full size

Press enter or click to view image in full size

Fuji‑Q

Press enter or click to view image in full size

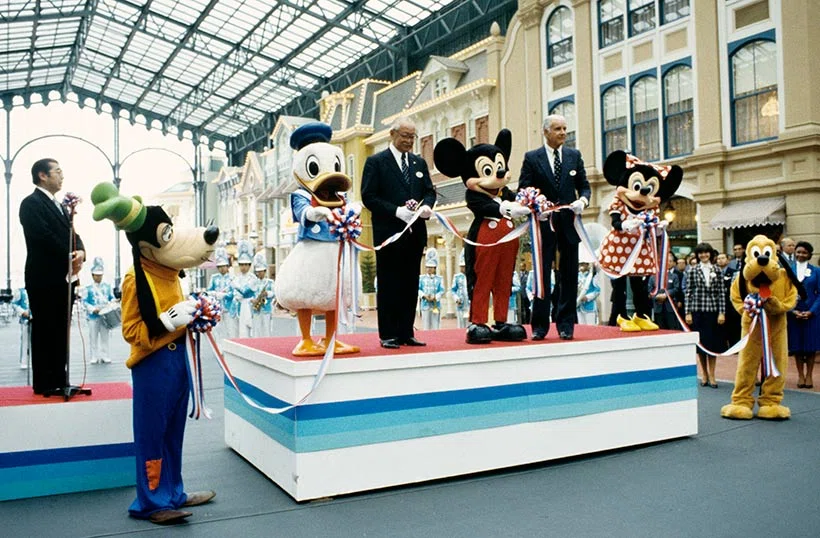

“Opening Day, April 15, 1983” by tokyodisneyreport.jp

By 2001, Tokyo DisneySea matured the format, and Universal Studios Japan (USJ) — opened the same year — would later be elevated inside an IP conglomerate through staged acquisitions by Comcast.

Press enter or click to view image in full size

Press enter or click to view image in full size

Beyond imports, the 1990s onward saw a rise in domestic IP parks: Sanrio Puroland, the chaptered roll‑out of Ghibli Park, and Moominvalley Park — plus landscape‑themed venues such as Edo Wonderland and Huis Ten Bosch.

Press enter or click to view image in full size

Sanrio Puroland

Press enter or click to view image in full size

Moominvalley Park

Press enter or click to view image in full size

Press enter or click to view image in full size

Press enter or click to view image in full size

The Revenue Core: Price Emerges from Designing “Inventory = Time”

Japan’s operational edge is fine‑grained daily tuning across three variables: time, capacity, price.

- Dynamic pricing smooths peaks and troughs.

- Paid skip lines / premium access monetize the value of time.

- Slicing supply into minutes/slots ties price to inventory, allowing higher yields without collapsing throughput.

Fantasy Springs exemplifies the logic: capex → simultaneous design of flow, pricing, and supply → year‑round utilization. That triad clarifies payback horizons and diversifies risk.

Global Contrast: Same Variables, Different Purpose

The US mega‑park default emphasizes immediacy and revenue maximization: aggressive paid skip‑lines plus steep dynamic pricing to save guest time. Much of Europe adjusts seasonal calendars and hours with coarser daily controls.

Become a member

Japan starts from a different premise: normalize experience quality first. Timed entry and capacity control are primary; price is the dependent variable. The result: turn congestion into perceived value without breaking the in‑park rhythm (circulation, dwell, photo rituals). Japan also extends capex life by chaptered openings (phased launches) and by turning off‑peak illumination/events into assets that fill demand valleys.

There’s a second, often overlooked foundation: fandom‑native staff. A high share of performers and crew come from the fan community itself. Their world‑building fidelity (detail obsession) and guest engagement (drawing visitors into the story) raise satisfaction per minute — a quality uplift beyond pure queue management. Call it “world‑craft talent” — a uniquely Japanese multiplier.

Press enter or click to view image in full size

Sponsor Economics, Japanese Style

On top of tickets, merchandise, and F&B, Japan builds a fourth layer: sponsor revenue. From Tokyo Disney Resort’s sponsored attractions, shows, and restaurants to World Expo pavilions and KidZania’s corporate pavilions, brands co‑design the experience and buy space as a medium — not as ad wallpaper but as a full‑funnel touchpoint where visit × experience × purchase co‑occur.

For sponsors, this delivers brand lift (recall, affinity, consideration) and trackable outcomes (membership sign‑ups, app installs, limited‑SKU conversion). For guests, priority flows, trial/tasting, and exclusive content make the day tangibly better — usefulness and joy translate into brand affinity. For operators, sponsorship dampens revenue volatility and stabilizes cash flow. Yes, sponsorship exists everywhere, but Japan often goes further into co‑ownership of the experience (B2B2C), aligning design codes (color, material, tone) with the park’s world.

Expo 2025 Osaka, Kansai: A Six‑Month “Variable” Theme Park

From April 13 to October 13, 2025, the site on Yumeshima functions as a six‑month theme park where time slots, concurrent capacity, and price are operated at scale. Theme Weeks chapter the run; the Grand Ring orchestrates circulation and dwell. Brand pavilions — Cartier among them — validate Japan’s sponsor model as space‑as‑media on an international stage.

The Equity Story: Why Parks in Japan Behave Like Composite Assets

Japan’s shift from “entertainment” to “financeable asset” is easiest to see through ownership transitions (M&A/PE) and capital stacks.

Universal Studios Japan began in 2001 as a JV that included Osaka City, the then‑Japan Development Bank (now DBJ), domestic firms, and a Universal affiliate. In 2005, a recap made Goldman Sachs the lead shareholder (approx. 41% on a fully diluted basis). In 2009, Goldman Sachs led a TOB with MBK Partners and Owl Creek Partners to take the company private (Osaka City’s ~9% was sold in the process). Comcast (NBCUniversal) acquired 51% in 2015, then the remaining 49% in 2017 for ¥254.8 billion(~$1.72B), implying an enterprise value of ~¥840 billion(~$5.68B). The logic was a strategic integration of “operating muscle × IP supply”: new lands, pricing, and flow optimization now feed the parent’s growth flywheel.

Press enter or click to view image in full size

Huis Ten Bosch shows how PE‑style reorg plays in Japan. In 2010, one of the biggest Japanese travel agency, H.I.S. injected ¥2 billion(~$13.5M) via a third‑party allocation after a 100% capital reduction, taking control and dispatching management. After cost discipline, utilization recovery, and event investment, H.I.S. exited to PAG in 2022 at an equity valuation ~¥100 billion(~$0.68B); its 66.7% stake sold for ~¥66.6 billion(~$450M). It’s the textbook “low‑cost entry (via recap) → operational uplift → high‑value exit” — evidence that parks can deliver IRR like other complex assets.

Press enter or click to view image in full size

Huis Ten Bosch

JUNGLIA OKINAWA offers a third path: new‑build as financeable asset. With total project cost ~¥70 billion(~$0.47B), financing includes a ~¥36.6 billion(~$247M) syndicated loan arranged jointly by Shoko Chukin Bank and Ryukyu Bank (non‑recourse; sustainability‑linked), pulling in regional banks and policy finance. On equity, the Cool Japan Fund invested ~¥8 billion (~$54M) in Katana (the operating group) in 2022 (a business‑level investment to propel the Okinawa theme‑park initiative). The public risk capital crowds in private lenders, while the operating thesis — pricing time as inventory (resident vs. inbound tiering, Park & Spa bundling, premium flows) — translates payback into finance language. Even as a new park (opened 2025), the hybrid stack (public–private–regional) + Japanese operating protocol aims for replicability as an investment thesis.

JUNGLIA OKINAWA

Put together, these capital architectures — strategic consolidation (USJ), PE reorg (Huis Ten Bosch), and public–private project finance (JUNGLIA) — all assume a competent tuning of time × capacity × price, plus sponsor co‑creation and fandom‑native talent to lift both topline and guest satisfaction. When ownership (who holds it) clicks with operation (how it’s run), a theme park becomes an operating composite asset with stable cash flows and real growth optionality. Japan already shows convergent evidence — through M&A, PE, and public–private finance — that different entry points can lead to the same exit: asset‑class treatment.

What to Learn from Japan — and Where to Take It Next

The playbook is exportable. Package the Japanese operating protocol — chaptered openings, demand (capacity) management, variable pricing, the pricing of time, B2B2C sponsor co‑creation, and fandom‑native “world‑craft” talent — and deploy it via Acquire / Partner / Replicate. If you can present the model in investor language (IRR, payback horizon, stable CF), you can finance it — at home or abroad. Japan’s theme parks already function as investable operating assets; the next step is proving the protocol across borders.

We help global brands & investors win in Japan.

Pre‑Marketing & Partner Tour — partner mapping, consumer immersion, pricing playbooks.

Get the brief / book an intro → Kaho Satoyoshi on LinkedIn

Further Reading (JP)

- How LOEWE and FENDI turn Japanese IP into brand equity

https://medium.com/@japanmarketing_kaho/how-loewe-fendi-and-other-luxury-brands-are-turning-collaborations-with-japanese-ips-into-brand-151991911b1a - Why land prices soar in Niseko despite poor access: a brand strategy

https://medium.com/@japanmarketing_kaho/despite-terrible-access-niseko-tops-japans-land-price-growth-for-6-years-straight-and-now-25bc7d20edeb - Will “imma,” the virtual human used by Coach and PUMA, replace real models?

https://medium.com/@japanmarketing_kaho/who-is-imma-3b8c1ee8cb39